I understand nothing on very. How do i be certain that a gentle old age?

I understand nothing on very. How do i be certain that a gentle old age? Rescue posts to possess afterwards I am 59 yrs old and my

Rescue posts to possess afterwards

I am 59 yrs old and my husband is 58. The two of us anticipate performing up until our company is 67 and you may 63 respectively. I have has just relocated to a smaller sized assets worthy of $step 1.5 million yet still are obligated to pay $50,000 involved. It will be the permanently home. I have not any other genuine-estate assets. My better half have $450,000 within the awesome, and i has actually $380,000. The guy earns $140,000 a year and i earn $120,000 per year.

We would like to alive a soft old-age exactly what can i do to guarantee we can exercise? I am not economically experienced I really don’t even understand how superannuation work! Is it possible you explain what you should me personally in a very first method, please?

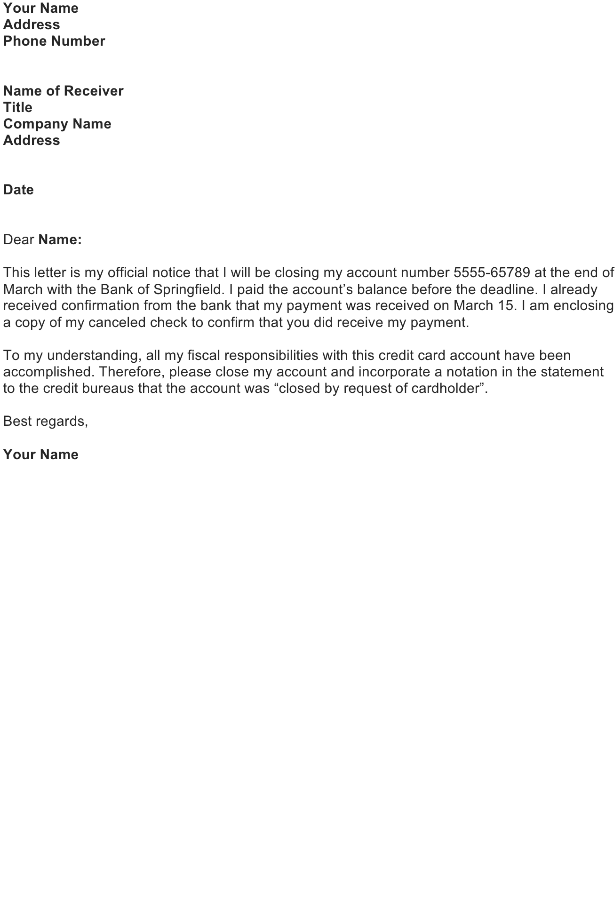

Awesome will likely be a complex beast, but facts also a little bit later in life renders a distinction. Credit: Simon Letch

You’re on the right tune, however need to do a spending plan to work out just how much do you consider you’ll spend after you retire, and capture advice for simply how much superannuation you may need to arrive one to objective.

A poor factor to have awesome shall be death of accessibility until you’re able to sixty and stop doing work in a position, but offered the years that is less of an issue getting your. The great thing about super is that you may build contributions of pre-taxation bucks and you may once you retire all distributions try tax-100 % free.

Noel Whittaker

The utmost deductible contribution may be $29,000 a year but this consists of brand new eleven.5 per cent workplace sum. The fresh new boss would be investing in $16,100 per year to suit your partner and you can $thirteen,800 a year for your requirements.

This enables your place to make income tax-deductible contributions away from $thirteen,900 and you will $16,two hundred correspondingly, or maybe more when you have bare share cover space from early in the day monetary age. You can repeat this unless you is actually 67. In the event you you to definitely I know pension ambitions would-be realised.

I am 60 and owe $350,000 to my financial. I am about to score $250,000 throughout the sale regarding my personal parents’ property. Was basically throwing upwards whether or not I ought to shell out $250,000 off of the mortgage otherwise lay those funds for the awesome. I hope to retire later the following year.

Because of the relatively brief timeframe until pension the real difference into the the interest rate are recharged on your own mortgage which is particular, and production out of your very loans that are a little uncertain, I think your best way is to try to afford the money out of your house mortgage that ought to slow down the equilibrium so you’re able to $100,000.

Going back 15 weeks of your own a position, be sure to place the limit deductible into extremely and employ that and almost every other all of the capital you’ll to pay off your house mortgage. A major objective for many people is to retire financial obligation free.

I am 59 could work income means $20,000 per annum and my capital income is approximately $120,000 per year. My awesome balance are $900,000. My mother desires to provide us with a young bucks heredity. Extent for my situation is $250,000. Must i rating their to place that it currency directly into my superannuation money or do i need to have the currency towards my personal account very first following https://paydayloansconnecticut.com/weston/ contribute to super?

An educated approach could well be for the mom to grant the money privately, and after that you dribble it with the awesome in the rate out-of a tax-deductible $30,000 a-year along with people employer sum. While doing so, you might reinvest the fresh new tax refund the fresh share would manage of the and additionally putting you to on extremely because the a non-concessional sum.

My spouse and i provides retirement benefits having reversionary nominations when you look at the go for of each and every other. Immediately after among us dies, (a) new survivor get a couple of your retirement streams until the demise and you will (b) the new survivor will need to nominate a binding passing recipient to possess each other people pension levels to replace the last reversionary pension nominations. Have I got that proper? Balance go for about $1.54 billion each and the audience is around the maximum import equilibrium hats.

Towards a connected material, particular element of the two retirement levels the fresh new survivor will likely then has actually might possibly be taxable toward survivor’s passing until he has got withdrawn certain otherwise every thing in advance of her demise. Has actually I experienced that right?

You are on the right track. New survivor takes across the reversionary retirement considering its remaining transfer equilibrium cap place can also be complement its equilibrium.

Otherwise, taking guidance so you can rightly reconstitute in this 12 months out-of demise commonly feel critical to end an excessive amount of cap affairs. The fresh death work for nominations ought to be applied.

With the survivor’s passing, people taxable role remaining into the retirement benefits was taxed to have beneficiaries particularly low-mainly based mature children.

Again, bringing advice today which have a perspective to apply actions such cashing away and you can recontributing part of their super balance when you find yourself both of you was live (in the event the below years 75) is reduce new taxable part and you may appropriately, brand new dying tax payable later.

- Recommendations provided in this article try general in nature that will be perhaps not meant to influence readers’ choices from the purchasing otherwise financial products. They have to usually search their unique expert advice which takes with the account her personal products before you make one economic behavior.

Pro guidelines on how to conserve, dedicate and then make one particular of your own currency brought to their inbox most of the Week-end. Register for our very own Real money publication.